We will show you how to find the correct award for restaurant, cafe, hospitality employees and calculate wages when public holidays occur.

Calculating hospitality wages can be confusing at the best of times. Even more so when a public holiday arises.

It seems that they never add up. Understanding the awards can be confusing.

We all know that a full-time employee’s award is 38 hours per week.

(Please – no jibes about those who work 50 hours per week on salary. That’s not what we’re debating here. This blog article is about teaching the right way to do payroll.)

Employees who work outside normal rosters or on public holidays get paid a higher rate of pay. Often this is a multiple of the base hourly rate. eg: 1.5x time and a half, 2x double time, 2.25x double time and a quarter, 2.5x double time and a half…. and so on.

This can get expensive for small business. So knowing the right way to calculate will keep employment costs in check and ensure employees are paid what they are entitled to. Understanding correct pay rates at different times helps business owners make good decisions when planning work rosters.

To do payroll right, you need the employee’s employment contract (for age, working hours and conditions), Tax File Number Declaration (for correct tax rate), reference to the correct Fair Work Award (for conditions and pay rates).

Look here to understand how to select the correct award

Let’s start with an example. This is only an example and indicative. Seek specific information for your circumstances by contacting Restaurant Bookkeepers Australia.

Employee: John Kitchen. Age 23. He works full time at a local cafe.

Award: Restaurant Industry Award 2010 MA000119

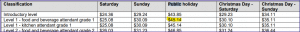

Classification: Level 1 – food and beverage attendant grade 1

Hourly Pay Rate: $20.06

Weekly Pay Rate: $762.10

Regular roster: Monday 6 hrs. Tuesday to Friday 8 hrs. Total 38 hrs.

Public Holiday: Australia Day 2020. Australia Day falls on Sunday 26 Jan. The gazetted public holiday is Monday 27 Jan. Therefore Monday will attract the penalty rates. John usually works 6 hours every Monday. He is entitled to not work that day, yet still be paid his normal rate of pay.

However, the business manager asks John to work 3 hours on Monday (Australia Day PH) because they will be busy. John is keen to earn more money so agrees to the shift.

We know the correct award for John is the Restaurant Industry Award. Go to Fair Work and look up the current awards for public holidays.

As at January 2020, the Public Holiday rate for John was $45.14 per hour.

By reading the conditions of the award, you will find that if John is asked to work a public holiday, he must be paid a minimum of 4 hours – even if he only works for 3 hours. (as per the Fair Work award: paragraph 34.4 a and 34.4 b; a full time employees must be paid a minimum of 4 hours. Casuals must be paid a minimum of 2 hours)

Extract from Fair Work Restaurant Award Jan 2020

So let’s put this together.

- John’s ordinary hourly rate: $20.06

John’s public holiday hourly rate: $45.14 (this is a loading of 225%)

Actual hours worked: 3 hours

Entitled hours for payment: 4 hours

Normal shift for Mondays: 6 hours

Superannuation: yes - $ 40.12 = 2 hrs @ $20.06 ordinary rate – not worked on the public holiday

- $180.56 = 4 hrs @ $45.14. Calculated by 3 hrs worked + 1 hr entitlement as if worked. Minimum hours to be paid when working a public holiday is 4 hrs.

- $220.68 = total payment for the public holiday including hours worked.

Next consideration is superannuation – the Superannuation Guarantee – SG. Fair Work will not give advice on superannuation entitlements. Super information needs to be obtained from the Australian Taxation Office ATO.

For John’s circumstances, Monday would usually be a normal day of work. Even though the gazetted public holiday falls on that day. Therefore, superannuation does apply to the wages for that day. It is not classed as overtime.

- $220.68 total wages

- $ 20.96 SG super calculated at 9.5%

- $241.64 = total wages and super.

If you need help with payroll or don’t want the hassle, call 1300 043 327 or drop us a line here

For your cafe bookkeeping and restaurant bookkeeping ideas and solutions – go direct to www.RestaurantBookkeepers.com.au .

The original hospitality experts servicing Australia.