You may be wondering why your bookkeeper wants you to keep all the little business receipts or tax invoices from every single thing that you buy. No, we aren’t trying to annoy you.

We want to:

- Get your business numbers to be the best reflection of how it’s performing (accurate numbers = better business decisions)

- Make sure you don’t get pinged by the ATO (an ATO audit will hurt)

- Identify any fraudulent transactions and bring them to your attention (yes, we have found fraudulent shopping from Nigeria)

- Do our work as fast and efficiently as possible (good document management saves you time and money, stops us bugging you, and we love our job more)

These tips are especially useful if scanning receipts to electronic filing software such as Hubdoc, Receipt Bank and Lightyear. Same with scanning directly to accounting software such as Xero, MYOB and Quickbooks.

Let’s have a closer look at those annoying bits of paper thrown into your wallet after a hasty purchase.

Business receipts explained

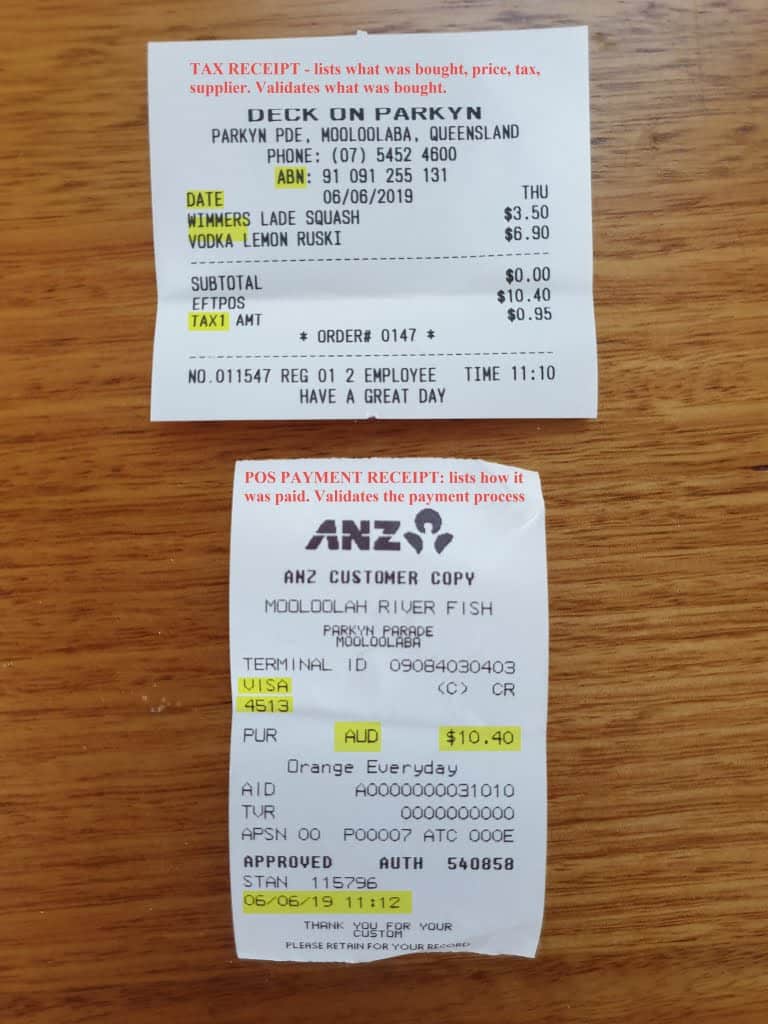

There are 2 sections to receipts when paying using a card. Both help with identifying proof of purchase.

- The Tax Invoice receipt – WHAT WAS BOUGHT: This docket shows the products bought, prices and GST breakdown. It also indicates if payment was by card or cash. This docket is usually ripped out of a cash register. It tells us how much GST tax refund to claim from the ATO and which expenses the company needs to account for in financial statements.

Tax receipts validate what was bought. - The POS payment receipt – HOW IT WAS PAID: It is a receipt to show how much money was taken from your online banking account. This is not a tax invoice! This docket is usually ripped out of a small POS machine. It tells us which bank account to allocate the payment to, or which employee to reimburse. The tax invoice usually notes if the purchase was paid for with cash.

POS machines are payment processors connected to electronic secure payment systems. They have access to your bank account after you tap your card, for instance. A payment processor acts as a mediator between you and your cards, your bank, the merchant and the merchant’s bank.

For e-commerce online payments, another layer of security is applied via payment gateways (that’s another story).

Some types of payment processors, such as Square, Tyro, eWay and some banks, provide this service with POS terminals.

POS receipts validate the electronic method of payment.

Get it right: what next?

Both of the abovementioned receipts are important, so make sure you ask the shop attendant for the tax receipt and the POS docket. Put both together and scan as one file, then email or upload to your electronic document system.

Sometimes the information is merged into one longer receipt – that’s ok too. Just make sure you scan/photograph the entire docket so we can see ALL of the information.

To sum up; one docket tells us what was bought and the tax details. The other one tells us how it was paid.

If it’s all on one business receipt – make sure we can see all the information clearly.

If it’s all on one business receipt – make sure we can see all the information clearly.

Always ask for both dockets of the transaction and send together so we can be fast and efficient in keeping your bookkeeping up to date

Have a look at the attached example for notes on what we look for in receipts and POS dockets.

Tip: Develop a new habit. As soon as you make a purchase, snap the receipts on your phone and upload directly to Hubdoc or Receipt Bank. Most importantly, check that it loaded before throwing the receipts away.

Clean wallet – now sorted!

Clean wallet – now sorted!

Get other great tips for streamlining your hospitality bookkeeping with our free downloadable eBook. Click here to check it out now.