We believe that staff Christmas parties should be banned. Sounds harsh, doesn’t it?

We learned a long time ago that a Christmas party of silly hats, cheap gifts and a dinner with too much beer does not grow people and strengthen teams. But experiences enjoyed together does.

Replace your Christmas parties with team building training events that have the wow factor and will develop your people. Make them fun and build excitement. This is your lifelong gift to your team.

The costs of an ‘experience’ Christmas party can be similar to a late night boozy meal. Sure, pizzas in the kitchen at the end of the shift is a full tax deduction, but are you really getting the best value from your team? You may be missing out on other benefits that don’t immediately equate to dollars.

How to Plan Your Team Building Christmas Party

- Choose a theme to tie into the event experience. Then use that theme to open discussions and ideas about personal development. If you want proactive, enthusiastic employees, you can demonstrate that through excellent leadership and using every opportunity to develop your people.

- Confirm the date with the team. But keep the actual event details a surprise – but do give clues leading up to the day. The suspense will keep them hooked until the last minute. Another advantage: in the busy lead up to Christmas, no one will resign because of ‘FOMO’ – Fear Of Missing Out on the Christmas event.

We all love top-shelf champers and the latest craft beer, but your Christmas party doesn’t have to be about the alcohol. Get drunk on adrenaline instead. Wherever you are, you can choose an exciting activity nearby and pick a theme to develop your team. Here are some ideas:

| Region | Activity | Starting Price | Venue |

|---|---|---|---|

| QUEENSLAND | Surf Lessons | $39 | Caloundra |

| Private Stand Up Paddle Board Lessons | $55 | Noosa | |

| Jet Ski Safaris (no licence required) | $60 | Gold Coast | |

| Helicopter Joy Flights | $65 | Gold Coast | |

| Sunset Cruise with 3 Course Dinner | $105 | Cairns | |

| Wildlife and Rainforest Quad Bike Tour | $125 | Cairns | |

| Story Bridge Climb | $129 | Brisbane | |

| Group Kayaking & Bridge Climb (including food) | $170 | Sea World Gold Coast | |

| NEW SOUTH WALES | Ghost Tour of Historic Sydney | $45 | Sydney |

| Horse Riding | $50 | Badgerys Creek | |

| Sydney Harbour Cruise with Taronga Zoo Entry | $63 | Sydney | |

| Skywalk Sydney Tower | $70 | Sydney | |

| Indoor Skydiving | $119 | Sydney | |

| Helicopter Joy Flight | $159 | Sydney | |

| Clay Target Shooting | $160 | Cecil Park | |

| V8 Car Driving | $229 | Sydney | |

| VICTORIA | Tree Surfing and Beer Tasting | $70 | Mornington Peninsula |

| Massage and Surrender Package | $155 | Melbourne |

| Theme | Lesson | Activity |

|---|---|---|

| Pivot | Life doesn’t always go according to plan, so you must pivot. | Helicopter flights |

| Scale to New Heights | Conquer your fears and reach for the stars. | Story Bridge climb |

| Laser Focus | Keep your eye on your goals as you execute them. | Clay shooting |

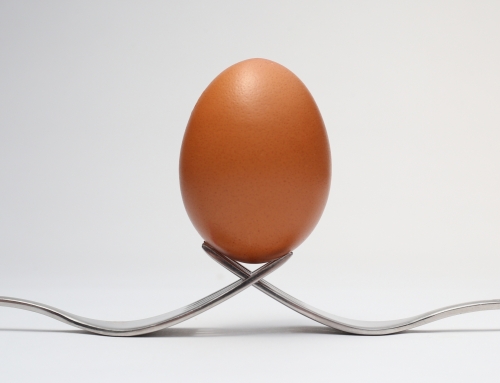

| Balance | Find balance in your life to achieve your goals. | Stand Up Paddleboarding |

Most places offer team discounts. Check online deals via Red Balloon and Adrenalin.

Remember: the safety of your employees is paramount. Consider the age and physical restrictions of your team. You will be surprised at what people will attempt when they are encouraged and supported by the team.

While we suggest that you take your team away from the restaurant for some fun, we certainly want your diners to bring ‘their’ office Christmas parties to your restaurant to increase your sales. Make sure you give your diners a detailed tax invoice/receipt for their claiming!

Tax Implications of Entertainment

Now for the boring stuff. Entertainment expenses are usually non-deductible and attract Fringe Benefits Tax (FBT). Christmas parties are considered by the ATO to be entertainment, but they do have some ‘minor benefits’ exemptions (with restrictions). This is why a lot of businesses have a celebration at the business premises – because it’s exempt from Fringe Benefits Tax. The ATO considers Christmas parties ‘entertainment’ unless they are under $300 per employee and ‘infrequent and irregular’.

If you hold your Christmas party for employees:

- on the business premises,

- on a working day,

- and the cost of food and alcohol is less than $300 (inc GST) per employee,

the costs are exempt from FBT.

If you hold your Christmas party for employees:

- at another venue (restaurant),

- on a working day before Christmas and

- provide meals, drink and entertainment and the following applies:

- employees attend at a cost less than $300 (inc GST) per head

then there are no FBT implications because the Minor Benefits exemption applies if the necessary conditions have been satisfied.

However, if you invite employee’s partners then you may attract Fringe Benefit Tax of some conditions have been exceeded.

Decide the following:

Why: is the meal for work refreshment or social situation.

What: is it a light lunch or a 3-course meal.

When: is it during work time, or whilst travelling for work VS staff social function.

Where: is it at the business premises VS other venues eg: restaurant or cafe

Then consider if an exemption applies:

EXEMPT PROPERTY BENEFIT

Applies when food or drink is provided and consumed by an employee at the employer’s business premises at any time on a working day.

EXEMPT MINOR BENEFIT.

Applies when it has a taxable value of less than $300 and is provided infrequently and irregularly.

RECORDS TO KEEP.

Employers should record all information relating to entertainment so that the taxable value of the fringe benefit can be calculated. Details should include:

- The date you provided the entertainment.

- Who is the recipient of the entertainment?

- The cost of entertainment.

- The kind of entertainment provided.

- Where entertainment is provided.

Restaurant Bookkeepers suggest you bust out and do what is best for your team despite the tax man. Go ahead and create a fabulous team experience while shouldering or staying under the FBT implications. Talk to your accountant – it may be worth incurring a small FBT to get your team energised, productive and profitable. Think of the bigger picture. It may be a small price to pay for more team productivity and profit next year.

With a team building Christmas party, your team will thank you and mean it.

As for what to give as wrapped gifts – that’s another story!

Feel like reading the ATO information? Read their article about fringe benefits tax and Christmas parties.

Mise en place – No fuss!

Merry Christmas from Chris and team

Call 1300 043 327 (13 000 IDEAS)

It’s time for a fresh change.

www.RestaurantBookkeepers.com.au